Theory behind Harmonic Pattern Detection techniques

Harmonic patterns have very strong connection with Fibonacci numbers and Elliot Wave theory. Fibonacci numbers are much simpler than Harmonic Patterns. Harmonic Pattern uses more rigid rules in identifying the trend reversal patterns than Fibonacci number. Naturally Harmonic Patterns have more predictive power than simple Fibonacci numbers. Elliot Wave theory is much more complex for average traders. Elliot Wave theory suffers a lot from subjective counting rules and it is very difficult to apply in real trading environment. Harmonic Pattern Trading strategy can serve very well for both beginners and sophisticated traders in any financial markets. They are profitable if properly used.

The most widely used research method behind Harmonic patterns are the ratio and frequency studies. Unlike other quantitative description such as mean, standard deviation or median, ratio is insensitive to the scale. Therefore, both large pattern and small patterns can occurs under the same pattern category. The frequency is the key metrics determining the significance of the patterns from historical study. The frequency studies on various financial markets including equity, forex and future showed that several patterns are very strong trend reversal indicators. At least, couple of dozens of such patterns were reported officially and unofficially. However, not all the patterns have equal predictive powers.

Our Harmonic Pattern Detection Software including Harmonic Pattern Plus and Scenario Planner can detect 11 Harmonic Patterns with most predictive power including:

- Butterfly

- Gartley

- Bat

- Alternate Bat

- AB=CD

- Shark

- Crab

- Deep Crab

- Cypher

- 5-0 patterns

- 3 Drives pattern

Pattern Matching Error and Pattern Matching Accuracy

As harmonic pattern detection and statistical geometric pattern detection share a lot of common knowledge, we uses some established concepts from statistics, econometrics and other financial theory for our harmonic pattern software. Firstly we introduce the concept of pattern matching error. The pattern matching error is the error or difference between the detected pattern and the reference pattern in the text book. The pattern matching error simply represent how closely the detected patterns are matching to the reference pattern in the text book. Some traders might doubt why we don’t introduce the reverse concept of pattern accuracy (pattern accuracy = 1 – pattern matching error) instead of pattern matching error. Simply speaking, it is because it is the industrial standard to report the error than accuracy in many financial and statistical organization. But the difference between pattern matching error and accuracy is none. You need to get used to convert pattern matching error to pattern matching accuracy for your financial trading.

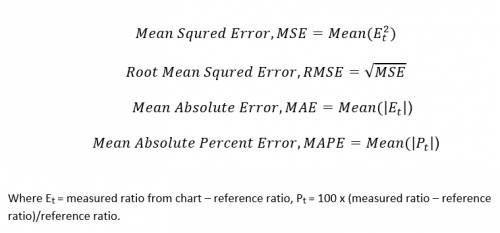

There are many error metrics or loss function can be used for pattern matching error for harmonic patterns including MSE (Mean Squared Error), RMSE (Root Mean Squared Error), MDE (Mean Absolute Error), MAPE (Mean Absolute Percent Error). We list some of common error functions for your better understanding:

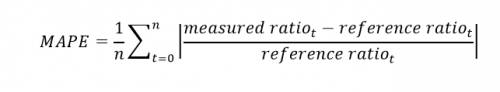

To provide the universal measure of pattern matching error regardless of pattern types and their size, we uses MAPE (Mean Absolute Percent Error) in our Harmonic Pattern Software. To help more clear understanding of our users, we present full formula for our pattern matching error, MAPE:

As the pattern matching accuracy is equal to 1 – pattern matching error, Harmonic pattern with smaller MAPE represents the cleaner and more beautiful pattern. Both our Harmonic Pattern Plus and Harmonic Pattern Scenario Planner will report MAPE to traders. Traders can use this MAPE metrics to fine tuning entry and exit timing for their trades. Also remember that both Harmonic Pattern Plus and Harmonic Pattern Scenario Planner have the ability to reply historical pattern from your charts for your complete strategy development.

Pattern Matching Accuracy vs Success Rate

One common mistake for traders is to take pattern matching accuracy (= 1 - pattern matching error) as success rate of the pattern. This is quite misleading and traders must not confuse between pattern matching accuracy and success rate. Pattern matching accuracy represents how closely the detected pattern are matching against the reference pattern from the text book. Pattern matching accuracy will tell you how much the shape of the detected patterns are like the reference pattern traders know. Normally the detected patterns are expected to have MAPE less than 10%. However, we often observe that some patterns are as ugly as having MAPE 25%, but they still have quite good predictive power.

On the other ends, Success rate represents how many times the patterns were successfully predicted the trend reversal in historical data. The success rate is highly subjective to pattern itself. For example, Shark pattern and butterfly pattern have different success rate. Our harmonic pattern software is well designed for you to study the success rate of each patterns and to improve your trading skills. Although we have pointed the difference between patterns matching accuracy and success rate by their definition, both also have strong connection too. For example, you will less likely to make a mistake in your trading when you spot the patterns with smaller MAPE in your charts. Because the pattern with large MAPE might indicate that the pattern is still immaturely formed, therefore the price might continue to move in the trend direction instead of tuning.

Further note on Pattern Matching Error and Accuracy

As we described, there are quite bit of mathematics used to describe how closely the detected harmonic patterns are matching against the ideal patterns. We did it by taking industrial standard approach. For professional traders and investors, this can be very usual things they come across in their trading floor everyday. Although there are little bit of theory to digest, traders are not necessarily need to know the math behind our pattern detection theory. Therefore, our harmonic pattern software can be used for any level of traders including beginners. So feel free to give a go with our harmonic pattern software. Traders just need to know that smaller MAPE (%) for the detected pattern indicates that the detected pattern is more close to ideal or perfect patterns from the text book.